Flying for the first time since a failure in early July, Rocket Lab’s Electron launcher delivered Capella Space’s first commercial radar remote sensing satellite to orbit after lifting off from New Zealand Sunday.

The successful mission signaled a return to launch operations for Rocket Lab, a leader in the small satellite launch market, after suffering a failure on the last Electron flight July 4. Investigators traced the cause of the failure to a single faulty electrical connector on the second stage, which detached in flight and led to a premature engine shutdown.

The rocket re-entered the atmosphere and burned up, destroying seven small commercial satellites. It was Rocket Lab’s first failure since beginning commercial service, in which time the U.S.-based launch provider racked up 11 successful mission in a row.

Rocket Lab said last month it will implement improved testing to better screen for bad connectors, and the Electron rocket performed flawlessly Sunday.

The 55-foot-tall (17-meter), two-stage small satellite launcher took off at 11:05:47 p.m. EDT Sunday (0305:47 GMT Monday) from Rocket Lab’s privately-owned spaceport at Mahia Peninsula in New Zealand.

The launch occurred at 3:05 p.m. local time Monday in New Zealand, and the kerosene-fueled rocket pitched on an easterly course from Mahia. After shedding its first stage and payload fairing, the Electron’s second stage fired its single engine for six minutes to place Capella’s Sequoia radar remote sensing satellite into a preliminary transfer orbit.

The Electron second stage released a Curie kick stage to perform the mission’s final burn to place the Sequoia satellite into a targeted orbit at an altitude of 325 miles (525 kilometers). Rocket Lab ended its live launch webcast after the end of the second stage burn, but the company later confirmed on Twitter that the Curie stage deployed Sequoia into its planned orbit.

“Congratulations to the Capella Space team in this first step to building out a new constellation to provide important Earth observation data on-demand,” said Peter Beck, Rocket Lab’s founder and CEO, in a statement.

“Electron is the ideal launch vehicle for missions like this one, where the success of a foundational deployment relies heavily on a high level of control over orbit and schedule,” Beck said. “I’m also immensely proud of the team, their hard work, and dedication in returning Electron to the pad safely and quickly as we get back to frequent launches with an even more reliable launch vehicle for our small satellite customers.”

Liftoff of Rocket Lab’s Electron launcher, returning to service for the small satellite industry on its first flight since an in-flight failure last month.

WATCH LIVE: https://t.co/MyWRfNdTkt pic.twitter.com/WCTqOuYg9a

— Spaceflight Now (@SpaceflightNow) August 31, 2020

Rocket Lab says it has monthly launches scheduled for the rest of 2020. Major missions planned by Rocket Lab later this year include the company’s first flight from a new pad at Wallops Island, Virginia, and the first attempt to recover an Electron first stage after launch.

Capella’s Sequoia satellite was the sole payload on Sunday’s mission. With a launch weight of about 220 pounds, or 100 kilograms, it is the first of at least seven Earth-imaging radar satellites Capella is building and launching to supply sharp imagery to a range of government and commercial customers.

Headquartered in San Francisco, Capella plans a constellation of small satellites to enable rapid revisit, allowing the company’s orbiting radar observers to collect imagery of the same locations multiple times per day. That will allow government and commercial customers to detect changes in the environment.

Other remote sensing companies have similar business plans.

Planet, another San Francisco-based company, operates a fleet of around 150 small optical Earth observation satellites. BlackSky is also deploying a constellation of optical remote sensing spacecraft.

But Capella’s satellites use synthetic aperture radar technology, allowing imagery collection night and day and in all weather conditions. Optical satellites are limited to observations in daylight and in cloud-free skies.

Payam Banazadeh, founder and CEO of Capella, says much of the early demand for the company’s imagery is coming from governments.

“I think initially it’s going to be government, defense and intelligence, both for the domestic U.S. government as well as international governments,” Banazadeh said in an interview with Spaceflight Now before the launch of the Sequoia satellite. “That’s going to be the primary driver for a lot of the applications in the short term.”

Last year, the National Reconnaissance Office awarded Capella a contract to study the integration of Capella’s commercial radar imagery with the NRO’s government-owned surveillance satellites. The U.S. Air Force awarded Capella a contract in November 2019 to incorporate the company’s imagery into the Air Force’s virtual reality software.

Capella also has a contract with the Navy, and the National Geospatial-Intelligence Agency signed a Cooperative Research and Development Agreement, or CRADA, earlier this year to allow researchers from the U.S. government’s intelligence community to assist Capella.

An inter-satellite link with Inmarsat’s network of geostationary communications satellites will enable real-time tasking of Capella’s satellites. Customers can use an electronic portal to task a Capella satellite for a radar image.

“In the long term, like other remote sensing companies, everyone is really still trying to find those applications,” Banazadeh said. “The most interesting ones that we’re finding are things that require an understanding of change, whether it be monitoring infrastructure, or just looking around and identifying change.”

He identified pipeline, easement and infrastructure monitoring as possible uses for Capella’s imagery. Radar images are also helpful in identifying oil spills, tracking agriculture, and in disaster response.

A Finnish company named ICEYE is also building out a fleet of small commercial radar observation satellites. ICEYE has launched five radar satellites to date, more than Capella. But Capella is a U.S. company, which could give it an advantage selling to the U.S. military.

Capella has a license from NOAA, which regulates space-based remote sensing by U.S. companies, for a constellation of 36 small radar surveillance satellites. The company says it also has permission from U.S. regulators to sell high-resolution radar images globally.

Capella’s first test satellite, named Denali, launched in December 2018 on a rideshare mission aboard a SpaceX Falcon 9 rocket. After surveying prospective customers, Capella began redesigning its next series of larger satellites to gather sharper imagery, and collect more data on shorter notice, two leading demands from consumers of satellite remote sensing data.

Sequoia is the first of the new series of satellites, which Capella calls the Whitney line.

The Sequoia satellite was originally supposed to launch as a secondary payload on an Indian rocket in late 2019, but the mission was postponed, prompting Capella to move the satellite to a Falcon 9 launch, according to Banazadeh.

It was then booked to fly as a rideshare passenger on the Falcon 9 launch with Argentina’s SAOCOM 1B radar observation satellite in late March. But that launch was also delayed at the request of Argentina’s space agency as travel and work restrictions were implemented at the onset of the coronavirus pandemic.

That left Capella looking for another ride for Sequoia. Capella had previously signed a contract with Rocket Lab for a dedicated launch of a future satellite, and Banazadeh said the company decided instead to put Sequoia on the Rocket Lab mission.

Rocket Lab also encountered delays after an Electron launch failed in early July. Meanwhile, SAOCOM 1B launch preparations resumed and the Argentine satellite successfully launched Sunday from Cape Canaveral, hours before the Rocket Lab mission with Sequoia.

“We’ve been playing this aerospace poker thinking this is going to go before SAOCOM, and now it’s going pretty much at the same time,” Banazadeh said before the launch of Sequoia.

Sequoia’s orbit is inclined 45 degrees to the equator, taking the satellite over much of the world’s populated aeras.

“This mid-inclination allows us to give our customers immediate access to rapid coverage of important regions, including the Middle East, Korea, Japan, Europe, South East Asia, Africa, and the U.S.,” Banazadeh wrote in a blog post. “Like all of our Capella satellites, Sequoia will be able to see through clouds and in the dark and detect sub-0.5 meter changes on Earth’s surface.

“When fully deployed, our satellite constellation will offer hourly coverage of every point on Earth,” he wrote.

Two more Whitney-class satellites are expected to launch on a SpaceX rideshare mission into a polar sun-synchronous orbit later this year. Banazadeh said the experience with launch delays this year has reinforced the importance of having multiple rockets available to deliver Capella’s satellites into orbit.

After the seven Whitney-class satellites, Capella will assess demand to determine how many more satellites to launch.

“We’re putting up the seven, and the seven are funded and under production,” Banazadeh said. “After that, we plan to have more satellites, but whether it’s going to be 12, 24, or 36 is driven by our market, so as we launch more satellites and we identify where the market is going, we will respond to the market.”

Power-hungry radars can now fit on smallsats

Radar remote sensing is a newcomer in the small satellite market. Radar imaging from space has previously been limited to large government-owned satellites costing hundreds of millions of dollars.

Companies like Capella and ICEYE are trying to break that paradigm, thanks to hardware miniaturization and other technological advances.

Radar instruments have an appetite for high power, and radar antennas are usually large. Those requirements have previously forced radar imaging satellites to be large and expensive.

“Power and the size of the antennas are the two biggest constraints you have for a SAR (synthetic aperture radar) satellite, and that has secondary implications,” Banazadeh said. “You need a big antenna. There are two ways to get that. You can have a fixed antenna, or you can have a deployable antenna.”

With a fixed antenna, “you can only launch as the primary payload on big rockets, which increases your price per launch,” he said. “And if you’ve got a deployable antenna and not a fixed antenna, then it’s a little more complex in the structure you build to make sure it deploys appropriately.”

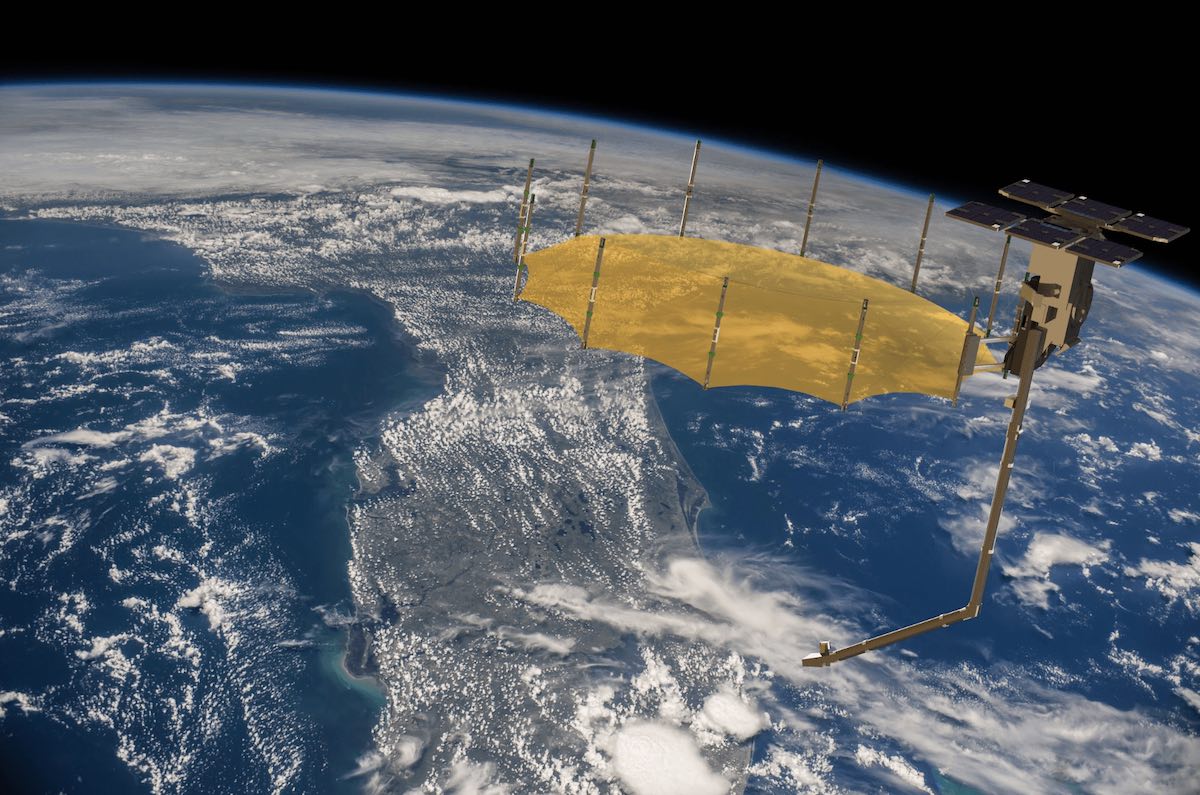

Capella went with a deployable mesh-based radar reflector antenna. It folds up origami-style for launch, but then unfurls to a diameter of about 11.5 feet (3.5 meters) after the satellite separates from its rocket in orbit. The antenna deployment adds some complexity to the satellite.

“The more complex the satellite the longer it takes to commission,” Banazadeh said. “We have quite a bit of deployable structures to deploy, and we’ll be working through that for a few weeks before we release imagery. We expect to be pretty busy for those first few weeks. We’re going to take our time, and we have to calibrate the instruments, so it will definitely be a process for us.”

Capella says its spacecraft will be capable of gathering radar images for 10 minutes out of every nearly 100-minute orbit, a relatively high duty cycle for a small radar satellite. The radar imager will have a resolution of better than 50 centimeters, or about 20 inches, and can produce images in strips up to 2,500 miles (4,000 kilometers) long, Capella says.

Banazadeh said other challenges in fielding a fleet of radar reconnaissance satellites include downlinking and processing the vast amount of data the fleet will produce.

There is still a role for bigger, more costly radar satellites, Banazadeh said.

The bigger satellites do have other advantages,” he said. “Where they’re lacking, I think, is going to be in the revisit.”

“So I don’t see it as a replacement,” Banazadeh said. “I see it as bringing a new capability that those companies and those satellites can’t also do. They can’t put put up seven of those even, let alone 20 or 30 with this cost. I think it’s very complementary.”

Email the author.

Follow Stephen Clark on Twitter: @StephenClark1.