On Monday, L3Harris Technologies, announced the intended sale of a majority stake in its Space Propulsion and Power Systems business to AE Industrial Partners, shifting control over one of its marquee engines: the RL10.

L3Harris, based in Melbourne, Florida, said the deal, valued at $845 million, is expected to closed during the second half of 2026. If approved by regulators, AE Industrial, a private investment firm based in Boca Raton, Florida, would control 60 percent of a new space technology business, which it said will be named “Rocketdyne,” reviving the standalone name for the company that was originally founded as a division of North American Aviation in 1955.

The trademark “Aerojet Rocketdyne” will still be retained by L3Harris.

“L3Harris is strongly committed to the Department of War’s (DoW) vision for a faster, more agile defense industrial base while remaining laser-focused on driving value for our shareholders and customers,” said Christopher Kubasik, Chairman and CEO of L3Harris, in a press release. “This transaction further aligns the L3Harris portfolio with DoW core mission priorities.”

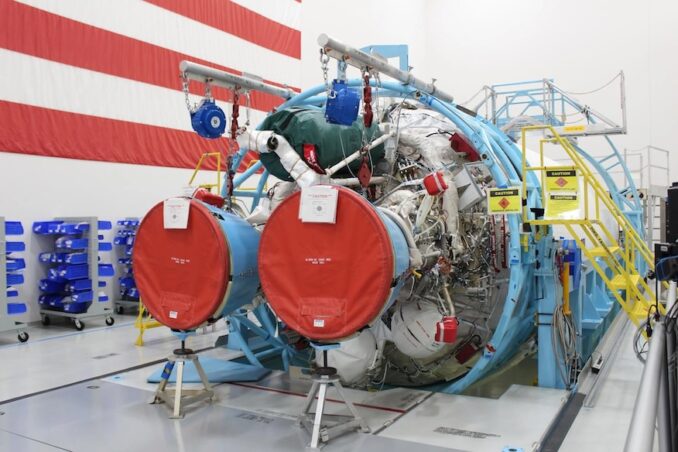

Notably, L3Harris stated explicitly in its press release that “L3Harris’ RS-25 engine business is excluded from the sale.” Kirk Konert, Managing Partner at AE Industrial said a focus for the the new Rocketdyne business will be to focus on the RL10, the upper stage engine used for both NASA’s Space Launch System rocket and United Launch Alliance’s Vulcan and Atlas 5 rockets.

“Rocketdyne’s growth roadmap includes international expansion, including Artemis-related programs, across its power, avionics, and in-space propulsion portfolios,” Konert said. “The company is one of few with the heritage and credibility required to execute against the ambitious timelines of the Artemis Program, and we are excited to support both the U.S. and its allies in that mission.”

Konert said Rocketdyne will also look to attract new entrants to the rocket launch space to use the RL10 engine “as new vehicles come online.

“Upper-stage engines are tightly integrated into vehicle architectures, so we do not expect wholesale engine swaps by current operators,” Konert said. “As future launch manufacturers emerge, we plan to partner Rocketdyne’s management with AE’s business development team to pursue next-generation upper-stage opportunities.”

Konert said Rocketdyne will focus on modernizing and ramping up production of the RL10 engine, leaning into its more than 15 years of experience with additive manufacturing and expanding it out to other products within the Rocketdyne portfolio.

“Beyond additive manufacturing, our focus is on practical throughput and scalability levers,” Konert said. “These include increasing inline and batch testing to relieve production bottlenecks, selectively rationalizing product lines to drive economies of scale, and pursuing targeted [mergers and acquisitions] to internalize long-lead or capacity-constrained components.”

This is far from AE Industrial’s first foray into investments within the space sector. It also has significant investments in Redwire Space, which it created in 2020, along with American Pacific Corporation, Calca Solutions, Firefly Aerospace and York Space Systems.