Lockheed Martin, the largest U.S. defense contractor, announced late Sunday that it has reached a deal valued at $4.4 billion to acquire Aerojet Rocketdyne, a supplier of engines to NASA’s Space Launch System moon rocket and United Launch Alliance’s Atlas, Delta, and Vulcan rockets.

The acquisition is another step in consolidation among U.S. aerospace contractors, following the $9.2 billion purchase of solid rocket builder Orbital ATK by Northrop Grumman in a deal that closed in 2018. The agreement announced Sunday will bring Aerojet Rocketdyne, one of the top U.S. providers of liquid rocket propulsion systems, under the umbrella of Lockheed Martin.

“The acquisition of Aerojet provides an opportunity to fully integrate a key component of our value chain, utilize our combined manufacturing expertise to improve efficiencies and production operations, and ultimately position us to be more competitive for our customers by harnessing the talent and skill of both Lockheed Martin and Aerojet Rocketdyne employees,” said Jim Taiclet, CEO of Lockheed Martin.

“We will deliver more innovative and affordable solutions to better meet our customers most challenging areas as a critical partner across our portfolio already, and this helps position us for even greater growth in hypersonics, missile defense, and space, which are key elements of the national defense strategy,” Taiclet said in a conference call with investment analysts Monday morning.

Taiclet said the purchase of Aerojet Rocketdyne has “real upside” for Lockheed Martin.

“Having the engineers as part of the same organization as they design integrated propulsion and overall system products, I think, is going to make Lockheed Martin, especially missiles and file control and space, much more effective,” Taiclet said. “We’ll also be faster to market. We’ll be also be more efficient … in other words less expensive to the end customer to deliver that product.”

Aerojet Rocketdyne was formed in 2013 by the merger of GenCorp, parent company of Aerojet, with Pratt & Whitney Rocketdyne.

The Rocketdyne business was established as a unit of North American Aviation in 1955, then became part of Rockwell International and Boeing through a series of defense industry consolidations. Pratt & Whitney bought the Rocketdyne business from Boeing in 2005 and held onto it until the merger with Aerojet in 2013.

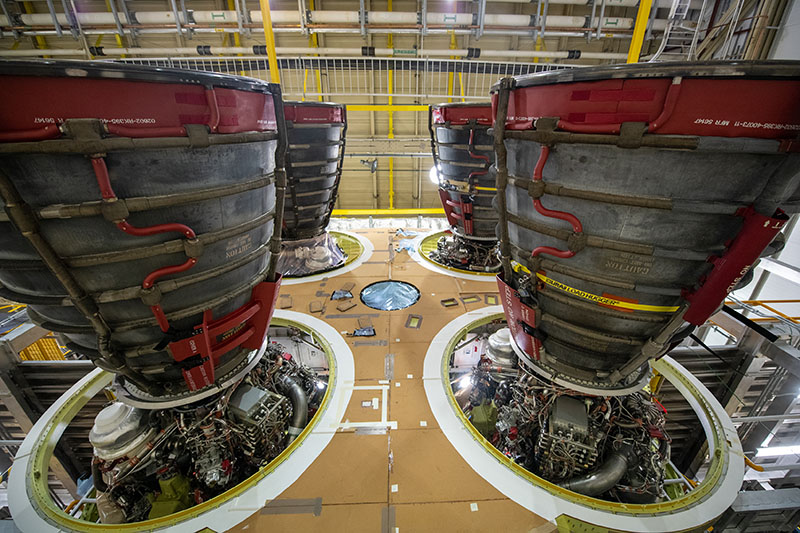

Rocketdyne built the powerful F-1 main engines for NASA’s Saturn 5 moon rocket and the reusable hydrogen-fueled main engines for the space shuttle. The remaining shuttle main engines, known as RS-25s, are being repurposed for NASA’s Space Launch System, a powerful launcher designed to send people back to the moon later this decade.

Aerojet was founded in 1942 and developed engines for the Titan rocket family, the engine for the Apollo service modules that flew to the moon, and orbital maneuvering system engines for the space shuttle.

But Aerojet Rocketdyne has been pressured by competition from commercial space companies like SpaceX and Blue Origin, led by billionaire entrepreneurs Elon Musk and Jeff Bezos. SpaceX’s Falcon 9 and Falcon Heavy rockets the firm’s own engines, and the company’s success in reusing rockets has cut costs, allowing SpaceX to take the lion’s share of new commercial launch contracts in recent years, and a growing percentage of government launch deals.

Taiclet said Lockheed Martin will fund the acquisition using new debt financing and cash on hand. The deal gives Aerojet Rocketdyne an equity value of $5 billion, but the transaction value will be $4.4 billion after Aerojet Rocketdyne issue a “special dividend” to its shareholders.

“The total consideration to be paid for Aerojet Rocketdyne is approximately 90 million shares, which … includes their convertible notes, will come to approximately $4.6 billion,” said Kenneth Possenriede, Lockheed Martin’s chief financial officer. “We will then pay off about $315 million of their term loan debt, and considering their projected cash balance, we see a projected transaction value of approximately $4.4 billion at closing.”

Aerojet Rocketdyne’s existing propulsion contracts with NASA include refurbishment of existing RS-25 engines for SLS missions, and the production of 24 new RS-25 engines for future SLS flights. NASA is paying Aerojet Rocketdyne nearly $3.5 billion for the manufacturing of the 24 new engines.

The company also builds RL10 upper stage engines used on the Space Launch System and on United Launch Alliance’s Atlas 5 and Delta 4 rockets, along with the the RS-68A first stage engine on the Delta 4. Aerojet Rocketdyne is also a supplier of rocket thrusters and electric propulsion systems used on numerous government and commercial spacecraft, including NASA’s Orion crew capsule for lunar missions and Boeing’s Starliner spacecraft to ferry crews to the International Space Station.

Faced with competition from SpaceX, ULA is developing a next-generation rocket named the Vulcan Centaur, and will retire the Atlas 5 and Delta 4 rocket in a few years.

ULA, a 50-50 joint venture between Boeing and Lockheed Martin, considered using a new engine from Aerojet Rocketdyne for the first stage of the Vulcan Centaur rocket. But the launch provider ended up selecting the BE-4 reusable methane-fueled engine made by Blue Origin, Jeff Bezos’s space company.

The Vulcan Centaur’s strap-on solid rocket boosters will be made by Northrop Grumman, using know-how acquired from Orbital ATK. ULA began flying a version of the new Northrop Grumman booster last month on an Atlas 5 rocket launch, replacing strap-on motors from Aerojet Rocketdyne that launched on previous Atlas 5 rockets.

Despite the loss of some of its ULA business, Aerojet Rocketdyne’s long-term multibillion-dollar contracts to support NASA’s Space Launch System and military projects has kept the company profitable.

Aerojet Rocketdyne also makes components for the Pentagon’s missile defense programs, and works on hypersonic propulsion for long-range military weapons systems and interceptors.

Lockheed Martin officials said Monday that the company’s acquisition of Aerojet Rocketdyne, pending approval from government regulators and by Aerojet Rocketdyne shareholders, is expected to close in the second half of 2021.

Taiclet, Lockheed Martin’s chief executive, said there are “operational benefits” to integrating Aerojet Rocketdyne’s propulsion systems with programs already in Lockheed Martin’s portfolio. Those include improved efficiency, tighter engineering integration, and better production planning, Taiclet said, strengthening Lockheed Martin’s capabilities in hypersonic programs, air and missile defense, and space exploration.

“We believe Aerojet Rocketdyne customers will also benefit, with Lockheed Martin providing engineering and manufacturing support to help them become an even better merchant suppler of propulsion products in the defense and space domain,” Taiclet said.

Taiclet said one area of savings for Lockheed Martin and Aerojet Rocketdyne customers will come in the elimination of subcontractor fees.

“There’s a phenomenon in our industry, fee on fee, meaning if we have a subcontractor, they’ll be charging their fee through us, and we’ll be charging our fee to the end customer,” Taiclet said. “If we can take out one of those fee levels, the overall product will be more affordable to our end customer.”

Possenriede said ULA represents about 10% of Aerojet Rocketdyne’s sales. Although Lockheed Martin owns 50% of ULA, the company expects to to continue including a fee in its sales of Aerojet Rocketdyne products to ULA, Possenriede said.

“We then would be a supplier to ULA,” he said. “We have an equity interest in ULA, but we don’t see any reason why we wouldn’t continue to put fee. It would still be a competitive price, of course, continue putting fee on our product as we sell into ULA.”

“We are pleased to bring together our complementary companies in a transformative transaction that will provide premium cash value for our shareholders and tremendous benefits for our employees, customers and partners,” said Eileen Drake, CEO and president of Aerojet Rocketdyne, in a statement.

“Joining Lockheed Martin is a testament to the world-class organization and team we’ve built and represents a natural next phase of our evolution,” Drake said. “As part of Lockheed Martin, we will bring our advanced technologies together with their substantial expertise and resources to accelerate our shared purpose: enabling the defense of our nation and space exploration.”

Email the author.

Follow Stephen Clark on Twitter: @StephenClark1.