DigitalGlobe’s WorldView 4 commercial Earth observation satellite, which launched in 2016 for a planned 10-to-12-year mission, has suffered a failure in its control moment gyros and is no longer able to acquire high-resolution imagery, officials announced Monday.

Maxar Technologies, DigitalGlobe’s parent company, said in a press release that the WorldView 4 spacecraft has lost an axis of stability due to the failure in the gyro system, which governs the satellite’s pointing, a requirement for aiming its telescope and camera toward targets on the ground.

“Efforts are ongoing in conjunction with its suppliers in an attempt to restore satellite functionality, but thus far these efforts have been unsuccessful,” Maxar said in a statement. “At this time, Maxar believes that WorldView 4 will likely not be recoverable and will no longer produce usable imagery.”

WorldView 4 was built by Lockheed Martin, and its control moment gyros were supplied by Honeywell, Maxar said. The high-resolution imaging satellite launched Nov. 11, 2016, aboard a United Launch Alliance Atlas 5 rocket from Vandenberg Air Force Base, California, with a planned design lifetime of 10-to-12 years.

The spinning control moment gyros govern the orientation, or pointing, of the satellite, giving it the stability to take sharp images with its 3.6-foot (1.1-meter) diameter telescope.

Maxar said ground controllers have put the WorldView 4 satellite in a safe configuration and will continue to monitor the satellite’s location and health.

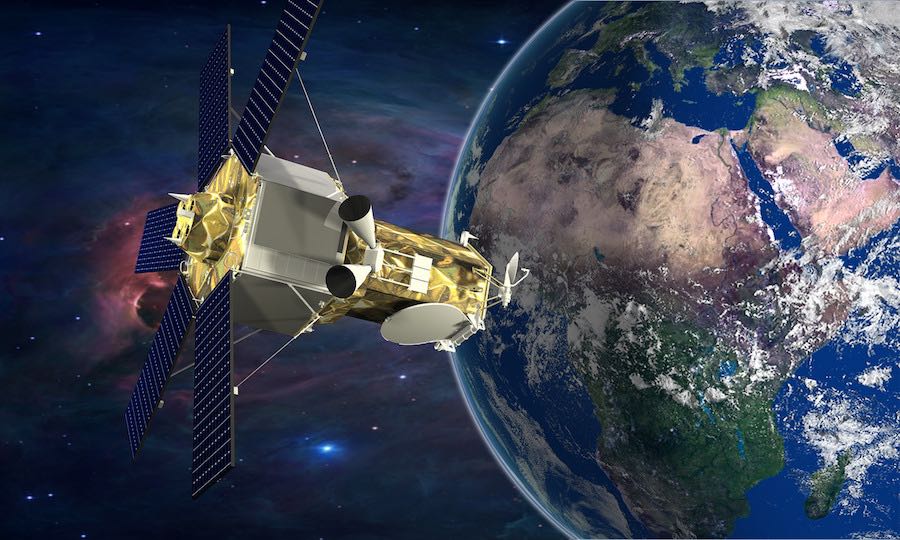

The WorldView 4 satellite is orbiting approximately 383 miles (617 kilometers) above Earth, following a north-south trajectory that takes it over the poles and enables global imaging coverage. It measures around 17.7 feet (5.3 meters) tall and 8 feet (2.5 meters) across, and its solar panels span 26 feet (7.9 meters) tip-to-tip.

When looking straight down, WorldView 4’s black-and-white imagery had a resolution of about 1 foot, or 31 centimeters, good enough to distinguish between a car, a van, or a truck, the best space-based imaging resolution on the commercial market. In color, the satellite could take images with 4.1-foot (1.24-meter) resolution, according to DigitalGlobe, and WorldView 4’s gyros could quickly pivot the spacecraft to scan different targets on the same flyover.

WorldView 4 could collect imagery covering more than 260,000 square miles (680,000 square kilometers) of Earth’s surface each day, an area equivalent to the size of Texas. The loss of WorldView 4 cuts DigitalGlobe’s highest-resolution imaging capacity in half.

DigitalGlobe’s WorldView 3 satellite, which launched in 2014 and continues operating, can capture imagery with the same resolution. WorldView 3’s sensors also give it an imaging capability deeper into infrared wavelengths than WorldView 4.

DigitalGlobe took over the WorldView 4 satellite’s development when the company merged with GeoEye in 2013. Originally named GeoEye 2, the WorldView 4 satellite was insured for $183 million, and Maxar said Monday it intends to seek full recovery for the loss of WorldView 4 under its insurance policies.

WorldView 4 generated revenues of approximately $85 million in fiscal year 2018, Maxar said. The company said it believes it will be able offset $10 to $15 million of the annual revenue from WorldView 3, and “will work to minimize the potential impact on Maxar’s financial results in future years.”

The largest consumer of DigitalGlobe imagery is the U.S. government, which supplements data from its own spy satellites with commercial imagery. International governments, oil and gas companies, agriculture interests, land developers, and mining firms also use DigitalGlobe’s imagery.

WorldView 4 was primarily used by DigitalGlobe’s commercial customers, while the other WorldView satellites are chiefly tasked with providing imagery to the U.S. government’s intelligence agencies.

“Contingency planning and mitigation efforts are underway to assess the use of the company’s other satellites and outside resources to replace imagery collected by WorldView 4 and meet as much of the existing customer commitments and obligations as possible,” Maxar said Monday.

DigitalGlobe is developing a new fleet of Earth observation satellites to replace the company’s oldest satellites — WorldView 1, GeoEye 1 and WorldView 2 — which launched in 2007, 2008 and 2009. The WorldView Legion constellation of small satellites will be built by SSL, another Maxar subsidiary, and the initial block of WorldView Legion spacecraft will launch in 2021 on two SpaceX Falcon 9 rockets with previously-flown first stage boosters.

DigitalGlobe officials say the company expects to invest around $600 million in the WorldView Legion program, but the company has not disclosed how many satellites will comprise the fleet.

Another DigitalGlobe Earth-imaging fleet developed in partnership with Saudi Arabia in the works. The six WorldView Scout satellites are smaller and provide lower-resolution imagery than DigitalGlobe’s other WorldView craft, but they will provide faster revisits over the same point on Earth, helping analysts track daily changes.

The expansion of DigitalGlobe’s fleet, which so far has emphasized ultra-sharp point imaging of specific targets, is designed to answer market demands for more timely image updates. One of DigitalGlobe’s competitors in the commercial Earth-imaging industry, Planet, operates a fleet of more than 100 spacecraft — mostly CubeSats designed for wide-angle imaging — in a network tailored for daily coverage.

Email the author.

Follow Stephen Clark on Twitter: @StephenClark1.